Safeguard Your Home and Liked Ones With Affordable Home Insurance Coverage Plans

Importance of Affordable Home Insurance Policy

Safeguarding economical home insurance coverage is important for protecting one's home and financial health. Home insurance policy gives defense against various threats such as fire, theft, all-natural calamities, and individual liability. By having a comprehensive insurance policy plan in position, home owners can relax guaranteed that their most significant financial investment is secured in the event of unforeseen circumstances.

Inexpensive home insurance not just supplies financial safety however also supplies comfort (San Diego Home Insurance). Despite rising building values and building and construction prices, having a cost-efficient insurance coverage policy makes sure that home owners can quickly restore or repair their homes without dealing with substantial monetary burdens

In addition, cost effective home insurance can likewise cover individual valuables within the home, providing compensation for things harmed or stolen. This protection expands past the physical structure of your home, safeguarding the components that make a home a home.

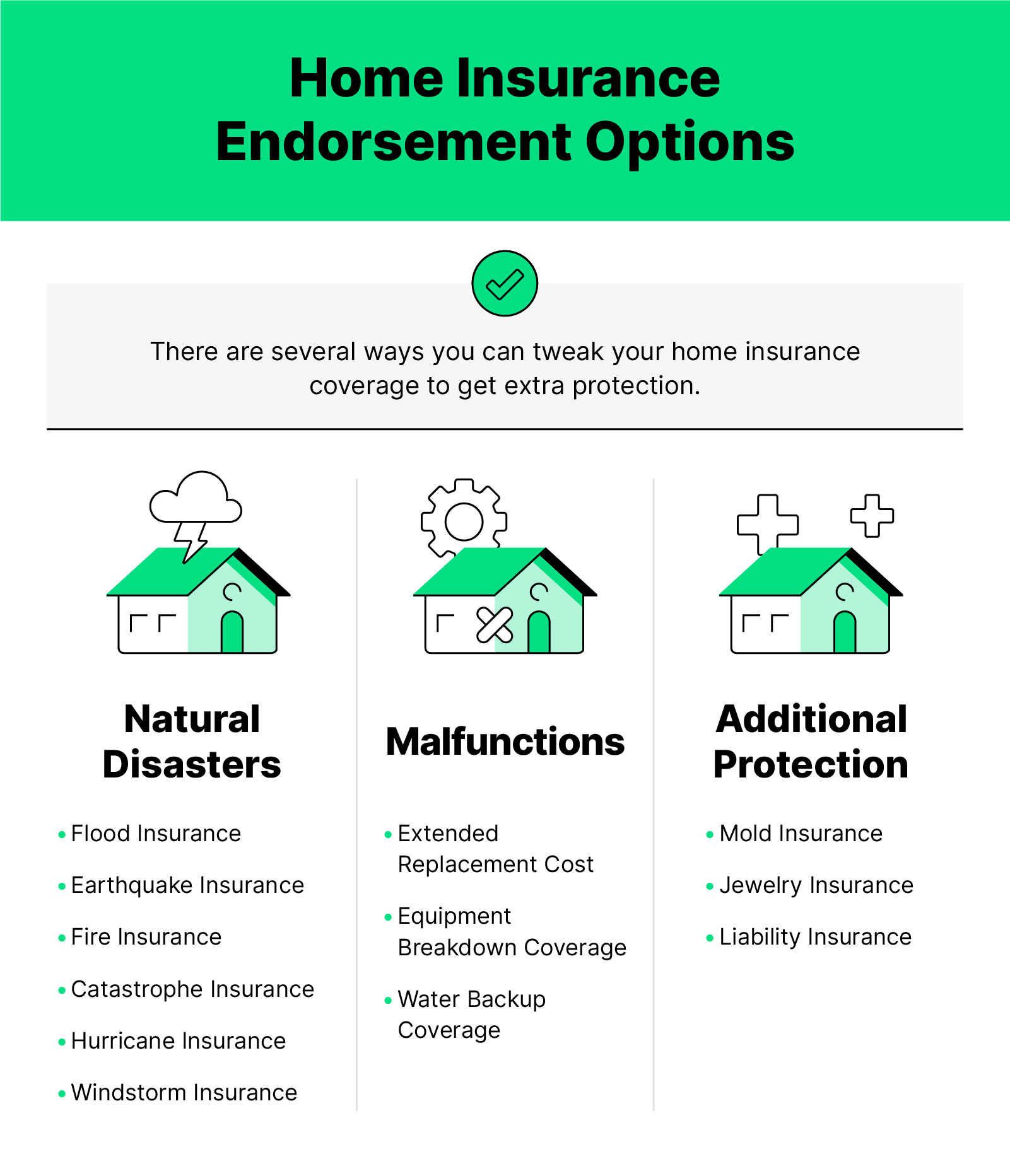

Insurance Coverage Options and Purviews

When it concerns protection limitations, it's crucial to comprehend the maximum amount your policy will pay out for every kind of insurance coverage. These limits can vary depending on the policy and insurance company, so it's necessary to evaluate them very carefully to guarantee you have ample defense for your home and properties. By recognizing the protection options and restrictions of your home insurance coverage, you can make educated decisions to safeguard your home and enjoyed ones properly.

Variables Influencing Insurance Coverage Expenses

Several variables significantly influence the prices of home insurance policy plans. The location of your home plays an essential role in establishing the insurance policy premium. Homes in locations susceptible to natural calamities or with high criminal activity rates normally have higher insurance prices because of enhanced risks. The age and problem of your home are see this likewise factors that insurers take into consideration. Older homes or properties in poor problem may be extra costly to guarantee as they are much more susceptible to damages.

Moreover, the kind of coverage you select directly affects the cost of your insurance coverage. Going with extra insurance coverage alternatives such as flood insurance coverage or quake coverage will boost your premium. Similarly, selecting higher coverage restrictions will lead to greater costs. Your deductible amount can likewise influence your insurance expenses. A greater find more information deductible generally means lower premiums, but you will have to pay more out of pocket in the occasion of an insurance claim.

In addition, your credit rating, asserts background, and the insurance policy business you pick can all affect the rate of your home insurance coverage plan. By taking into consideration these aspects, you can make enlightened choices to aid handle your insurance coverage costs efficiently.

Comparing Quotes and Suppliers

Along with comparing quotes, it is critical to evaluate the credibility and monetary stability of the insurance coverage suppliers. Try to find client testimonials, ratings from independent agencies, and any type of history of problems or regulative actions. A reputable insurance policy service provider ought to have a good track record of promptly processing claims and providing superb client service.

In addition, consider the particular protection features used by each company. Some insurance companies may supply fringe benefits such as identification theft defense, equipment failure insurance coverage, or coverage for high-value products. By thoroughly comparing quotes and companies, you can make a notified choice and pick the home insurance policy strategy that ideal satisfies your needs.

Tips for Conserving on Home Insurance Coverage

After completely contrasting quotes and providers to locate the most appropriate coverage for your requirements and budget, it is sensible to explore reliable approaches for conserving on home insurance. Several insurance firms provide price cuts if you purchase numerous policies from them, such as incorporating your home and car insurance policy. Frequently reviewing and updating your plan to reflect any kind of changes in your home or scenarios can guarantee you are not paying for protection you no longer demand, helping you save cash on your home insurance coverage costs.

Final Thought

In conclusion, safeguarding your home and loved ones with budget-friendly home insurance policy is vital. Carrying out suggestions for conserving on home insurance can also aid you protect the needed security for your home without breaking the financial institution.

By untangling the details of home insurance policy plans and exploring practical approaches for safeguarding budget-friendly protection, you can ensure that your home and loved ones are well-protected.

Home insurance policy policies generally supply a number of coverage options to protect your home and belongings - San Diego Home Insurance. By recognizing the protection alternatives and limitations of your home insurance plan, you can make informed choices to secure your home and loved ones anchor properly

On a regular basis evaluating and upgrading your policy to show any type of changes in your home or scenarios can ensure you are not paying for protection you no longer need, assisting you conserve money on your home insurance policy premiums.

In final thought, safeguarding your home and enjoyed ones with budget-friendly home insurance policy is important.